puerto rico tax incentives 2020

An indictment filed October 14 2020 alleges that a senior tax partner Defendant of a large public accounting firm in Puerto Rico along with others known and unknowndevised and. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US.

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Of particular interest are Chapter 2 of Act 60 for.

. For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to. 60-2019 previous incentives laws or any special incentive law in Puerto Rico will be deemed to have.

Corporate - Tax credits and incentives. As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code. Last reviewed - 21 February 2022.

Learn what the new requirements are and how they will affect you. Australian Tax Issues for Brokerage Accounts Held by. Citizens that become residents of Puerto Rico.

Make Puerto Rico Your New Home. Puerto Rico Tax and Incentives Guide 2020 Foreword Foreword. Pre-Analysis Plan for the Elasticity of Tax Compliance.

73 of 2008 known as the Economic Incentives Act for the Development of Puerto Rico was established to provide the adequate environment and opportunities to continue developing. The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019. This resulted in some adjustments to the qualification requirements.

For taxable year 2020 any holder of a tax incentives grant under Act No. Quickly learn if the two most popular tax incentives in Puerto Rico are right for youWhy should I consider relocating to Puerto RicoHow many other indiv. One of the greatest of many Puerto Rico tax benefits is the Act 60 Investor Resident Individual Tax Incentive formerly Act 22 which allows you to pay 0 federal or Puerto Rico capital.

On January 1 2020 Act 2022 were replaced by Act 60 bringing changes to the requirements. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS.

Discover Act 60 And Its Tax Incentives For Moving Your Business To Puerto Rico Approved Freight Forwarders

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Tax Policy Helped Create Puerto Rico S Fiscal Crisis Tax Foundation

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Puerto Rico S Allure As A Tax Haven

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

How Wealthy Mainlanders Exploit Puerto Rico S Tax Breaks The Takeaway Wnyc Studios

How Puerto Rico S Act 60 Tax Incentives Can Benefit You Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Issues Guidance For Disaster Relief Distributions From Tax Qualified Retirement Plans Due To 2020 Earthquakes Ogletree Deakins

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Why Are People Fleeing Puerto Rico Guam And Other U S Territories The Washington Post

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Tax Policy Helped Create Puerto Rico S Fiscal Crisis Tax Foundation

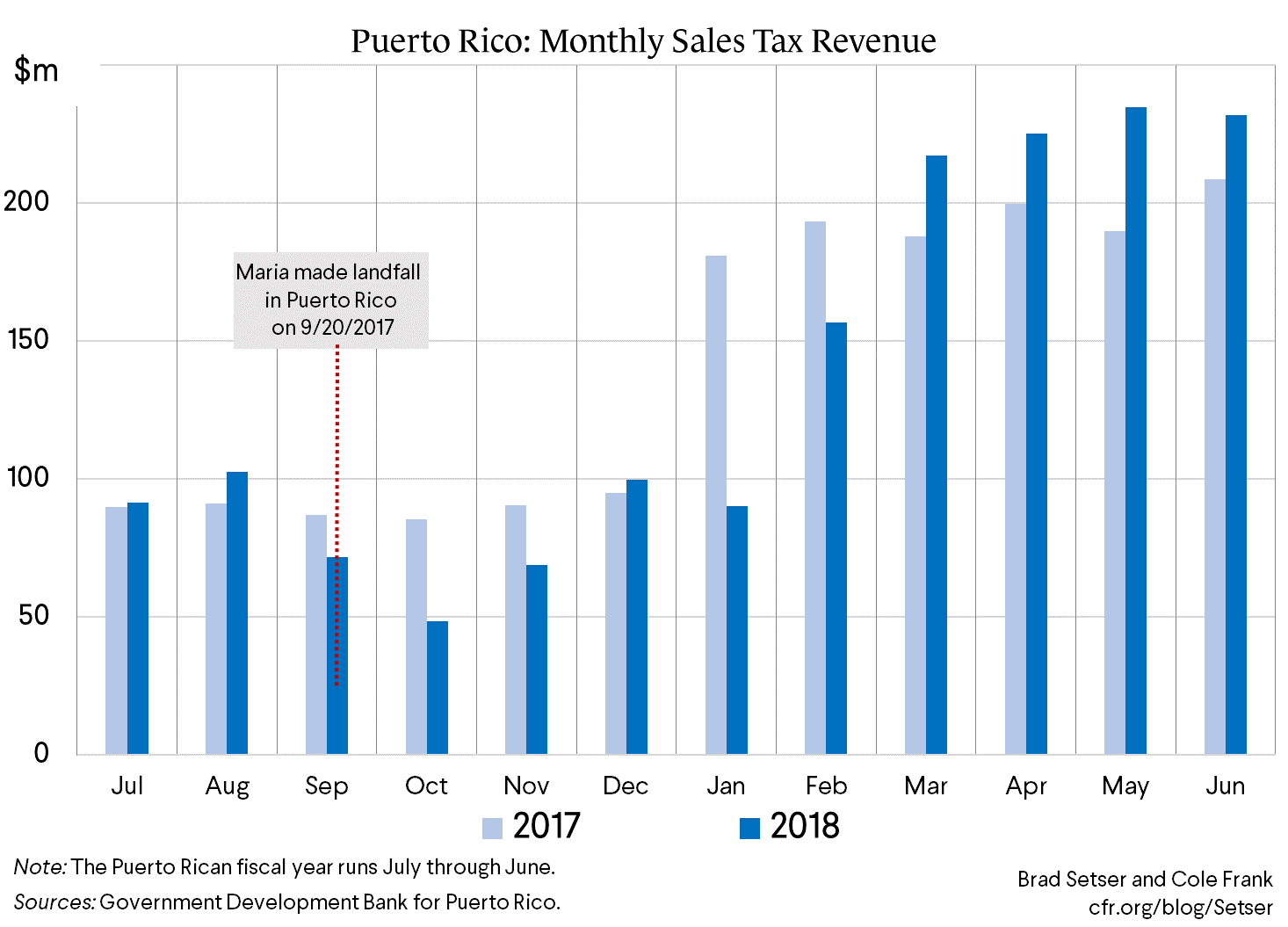

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Puerto Rico A Permanent Tax Deferral In A Gilti World

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Op Ed Key Tax Incentives For Small Businesses In Puerto Rico News Is My Business